Money advice that you can actually understand

So much money advice ignores who we are, our background, our values, and our emotions. I’ll show you how to be in better control of your money every week, even if you’re just starting out.

HELL YEAH, BOOKKEEPING

We help creative businesses run better and increase profits.

Bookkeeping, business management, outsourced CFO advisory.

FINANCE FOR THE PEOPLE

Combines practical advice and empathy of systemic issues that plague majority of folks

Available anywhere books are sold!

Hi friend, I’m Paco, author and illustrator of Finance for the People. I also run a bookkeeping agency for creatives and I live in Los Angeles.

If you asked 15-year-old Paco what she’d be when she grew up, she’d have said a musician, an animator, or anything creative. But…I didn’t want my immigrant parents to worry about me, so I chose finance and economics.

Having been in various financial service jobs – from debt collector to financial planner – I want to share three Truths about money I saw and learned over 16 years.

Truth #1: Knowledge is not enough

You can have a degree in finance and still be weird with money because we ignore one critical component: How we feel about money impacts our behavior with it. How do I know?

As an educated financial planner, I was flat broke.

Here I was creating plans for folks with net worths over 8 figures. Meanwhile, I was riding my bike 15 miles a day to save $40 a week on gas and growing my own lettuce to save $2. I had access to so much financial information, yet I myself struggled financially. How? (I did not know the answer to this until much later. Which ties into…)

Truth #2: We are what we tell ourselves

I started to wonder: Why am I OK making so little money? Why couldn’t I negotiate my pay with my boss? Why did I put someone else’s needs before my own? How could I be this weird about money?

I realized that my financial life wasn’t only impacted by a flawed system with rampant inequality but also that my upbringing and external messaging made me internalize a sense of unworthiness as a queer person. And it showed up in my relationship with money and in life. I knew I had to confront these narratives about worth and money to change my personal finances, but it took me a long time to recognize this and even more time to do the emotional labor.

Truth #3. Come into your own power and change your own life

I was lucky. Someone changed my life for me. When my last employer laid me off, he forced me to explore a different path. While I was figuring out what the hell to do, my circle of friends – largely artists, like musicians, filmmakers, painters, etc. – all kept asking me: “What the hell do I do with my money?”

Then it hit me: I could start a business that helps my creative community deal with their financial lives and relationships with money. This was the kernel that led me to start The Hell Yeah Group and Hell Yeah, Bookkeeping.

You’re in more control over your money than you think

Since this site’s inception in 2014, I’ve dedicated my life’s work to helping folks feel less weird about money, by having more frequent money conversations to exploring the benefits of facing our negative feelings about money.

Through my dozens of articles, a weekly newsletter, and my book Finance for the People, my goal is to help people understand that money is more than just money.

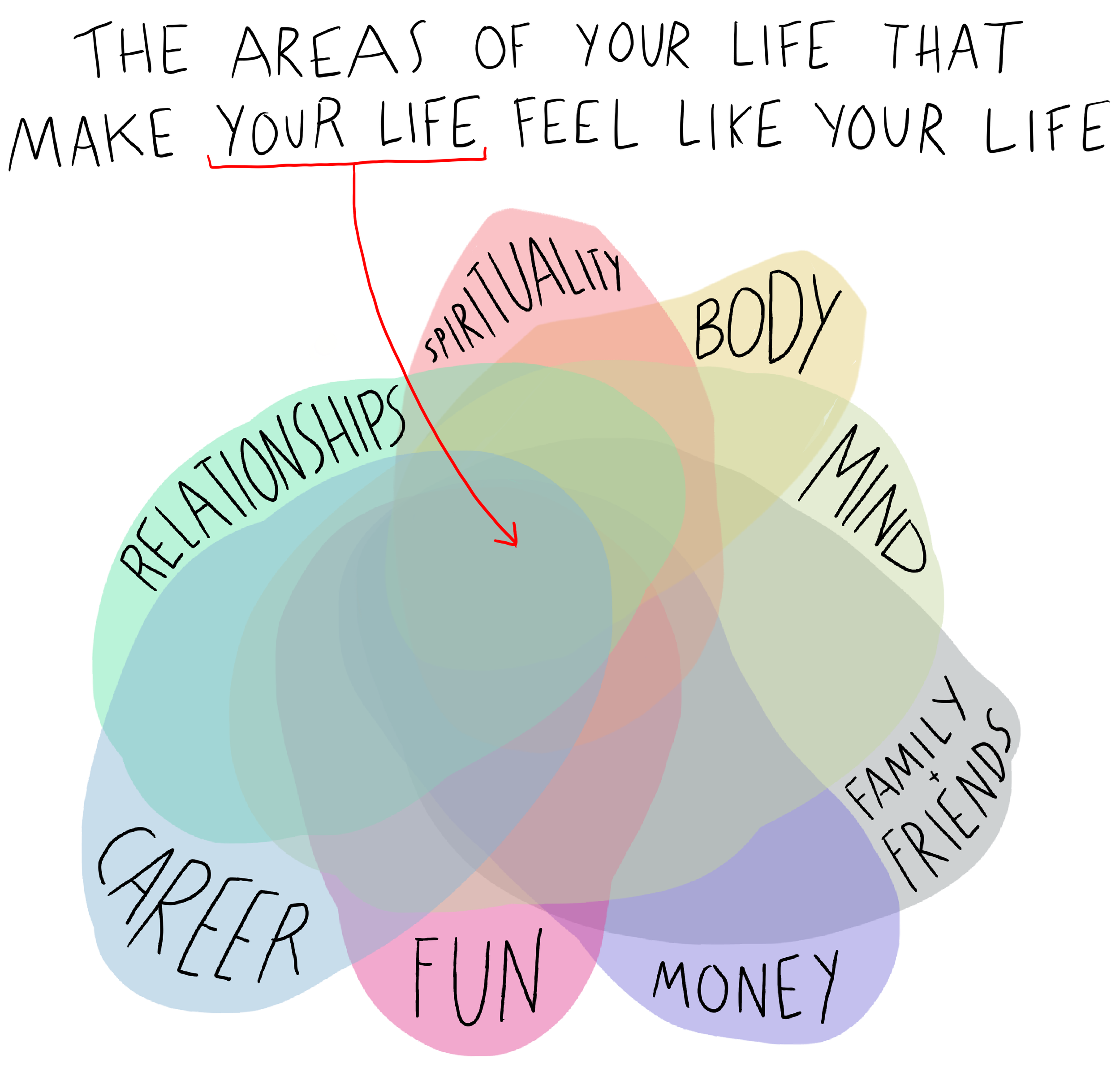

It's our emotions. Our beliefs. Our family. Our lives. It’s all interconnected.

Our financial system is stacked against the majority of us. I want to reach the folks that have felt ignored, unseen, and underserved by traditional money advice. The Hell Yeah Group, my book, and my work exist for this reason. I see you. And I'm here for you.

Let's feel less weird about money together.

Your favorite finance friend,

Get 2 FREE chapters of my book “Finance for the People”!

Plus, you’ll automatically get my weekly money newsletter Nerdletter that’s read by over 15,000 fine folks.