I know, I know. You think investing is not for you. Trust me when I tell you, I know how you feel. As someone who has been in the finance world - like actually in it - it’s easy to feel like you don’t belong there.

But it’s kind of our responsibility to work through that so we can actively participate. We have to know how something works before we can make any judgement about it. And we have to understand it before we try to change it. So, if you want to make a difference or if you just want to get rich, you have to pony up and grab a seat at the table. Even if you think you can’t afford to play, the truth is you can’t afford to not learn how to play.

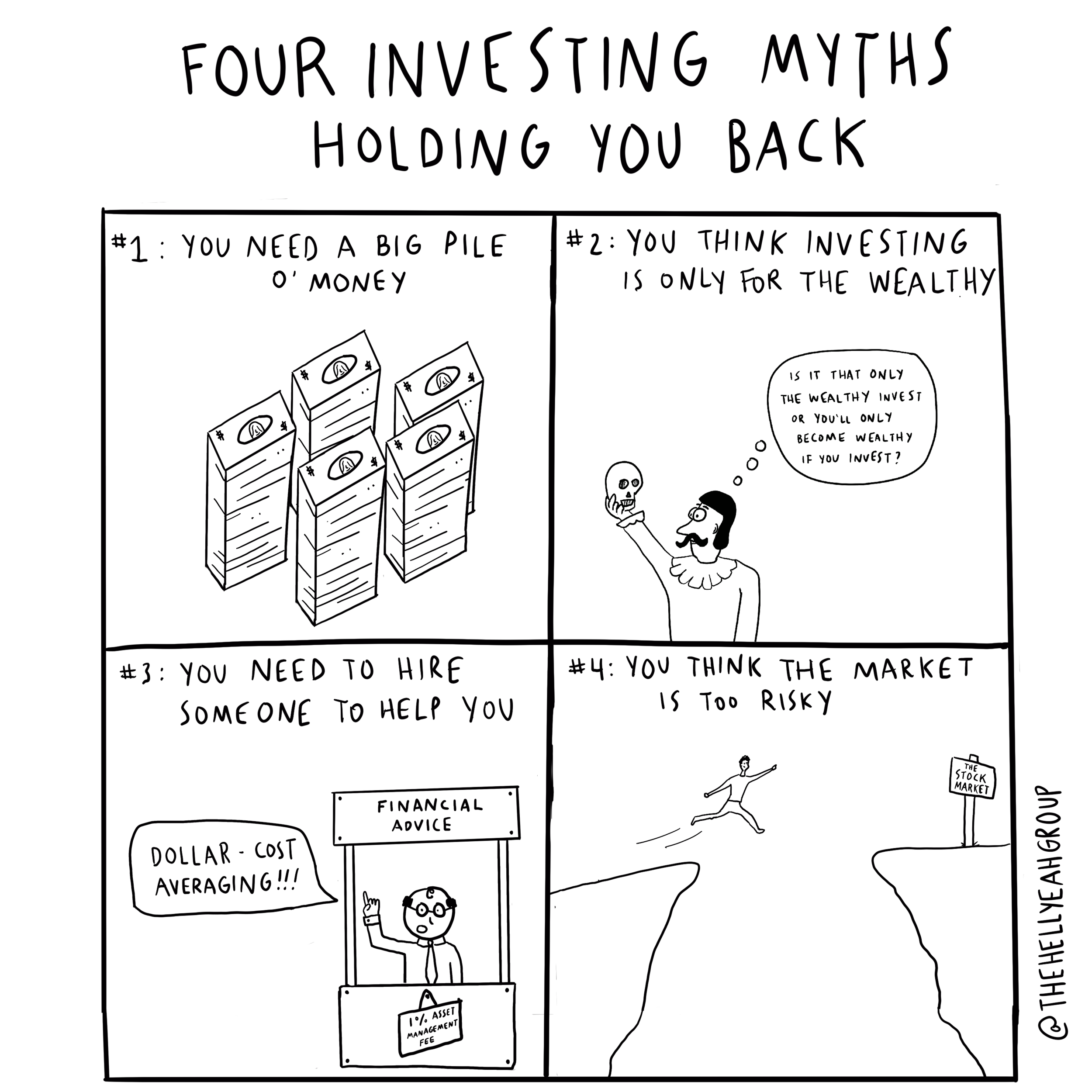

If you’re someone who has gotten close to investing, but never follows through, tried to learn, but has given up, it’s probably because you are letting these four common investing myths hold you back.

Myth #1: You Think You Need A Big Pile of Money

Nope. (But there are a few caveats). You can start investing today with very little money. Like, right now. Even if you can only afford $25/week or $25/month, it’s a good habit to build now.

My hope is that once you get started, you’ll start to see your money working for you as the dividends roll in. It might be small, a few bucks here and there. But once you start to actually see your money working for you, I hope that you’ll be motivated to keep investing.

Here are the caveats.

First, it would behoove you to have some money saved in your emergency fund before you start piling money into your investment account. Having cash on hand that you have access to in an emergency will prevent you from raiding your investment accounts.

The second is, if you want to hire a financial or investment advisor, some of them require that you have an account minimum because their fee is dependent on how much money you invest with them. So, that’s probably where a lot of people get that idea that investing requires you to first have a lot of money. Which brings us to myth number two.

Myth #2: You Think Investing Is Only for the Wealthy

Is it that only “successful” people wake up early or that you have to wake up early to become a “successful” person? The question is about causation and correlation and I see people make this flaw in logic a lot. They think only rich people can invest, when in fact, you can only become a rich person by investing.

Remember: You can invest right now, with a little bit of money, and over time, your investments grow.

Myth #3: You Think You Have to Hire Someone to Help You

I’m not totally against hiring an advisor, you can hire someone to help you, but you can absolutely do it yourself - especially when you’re just starting out and you have limited resources.

Investing seems complicated and it can be complicated, but it doesn’t have to be. You could spend a handful of afternoons learning everything you need to know about investing by reading or listening to a few short books. (My picks are Unshakeable: Your Financial Freedom Playbook and I Will Teach You to Be Rich).

Myth #4: You Think Investing Is Too Risky

Different investments have different risks. So, if you are the risk averse type, you can find ways to invest that are in line with the amount of risk you are willing to take. The names of the game are asset allocation and diversification.

Asset allocation is the act of investing in different categories of investments, called asset classes. You pick which assets you want to have in your portfolio. Generally, investors choose from stocks (equities), bonds (fixed income), cash, commodities and real estate.

Diversification, is the process of balancing the classes within these classes so they offset one another in an ever-changing market.

With roboadvisors and real advisors, you’ll take a risk tolerance questionnaire. Then, investments will be recommended to you based on your risk tolerance, investment goals, investment portfolio and your time horizon for investing.

To start investing today, check out my top picks for investment platforms:

Betterment - Low cost, easy-to-use, roboadvisor platform

Wealth Simple - Another low-cost, easy-to-use roboadvisor platform

Vanguard - A more classic investment platform with more access to different types of investment vehicles

It’s easy to hold onto your limiting beliefs about what you are capable of and where you think your place is in the world. It’s the devil you know. If you come from a family that has never invested their money, you might be challenged by your changing narrative or fear of venturing into a new unknown. You can dip your toe into the water, get acclimated slowly and figure it out over time. But first, you have to just start. You have to take action.