For the past year, I’ve been using an income account as a part of my weekly accounting process.

Accounting process sounds fancy, but it’s just a workflow process that I use every week. The reason I started using an income account was because I wanted to have a better understanding of how much I truly needed to earn. I also wanted to see if I could run my business with less money each month by only giving my business a certain amount of money to work with.

So about this time twelve months ago, I opened up a new checking account and called it my "Income Account.” And what I learned from doing this over the last year, was that this method is some next-level jedi shit. It helped me reframe how I was looking at my business finances. I learned that if I was diligently focused and tracking income every week, I was diligently focused on increasing the income. Before we get to that, let’s dive into the basics.

First, what is an income account?

Introducing the Income Account

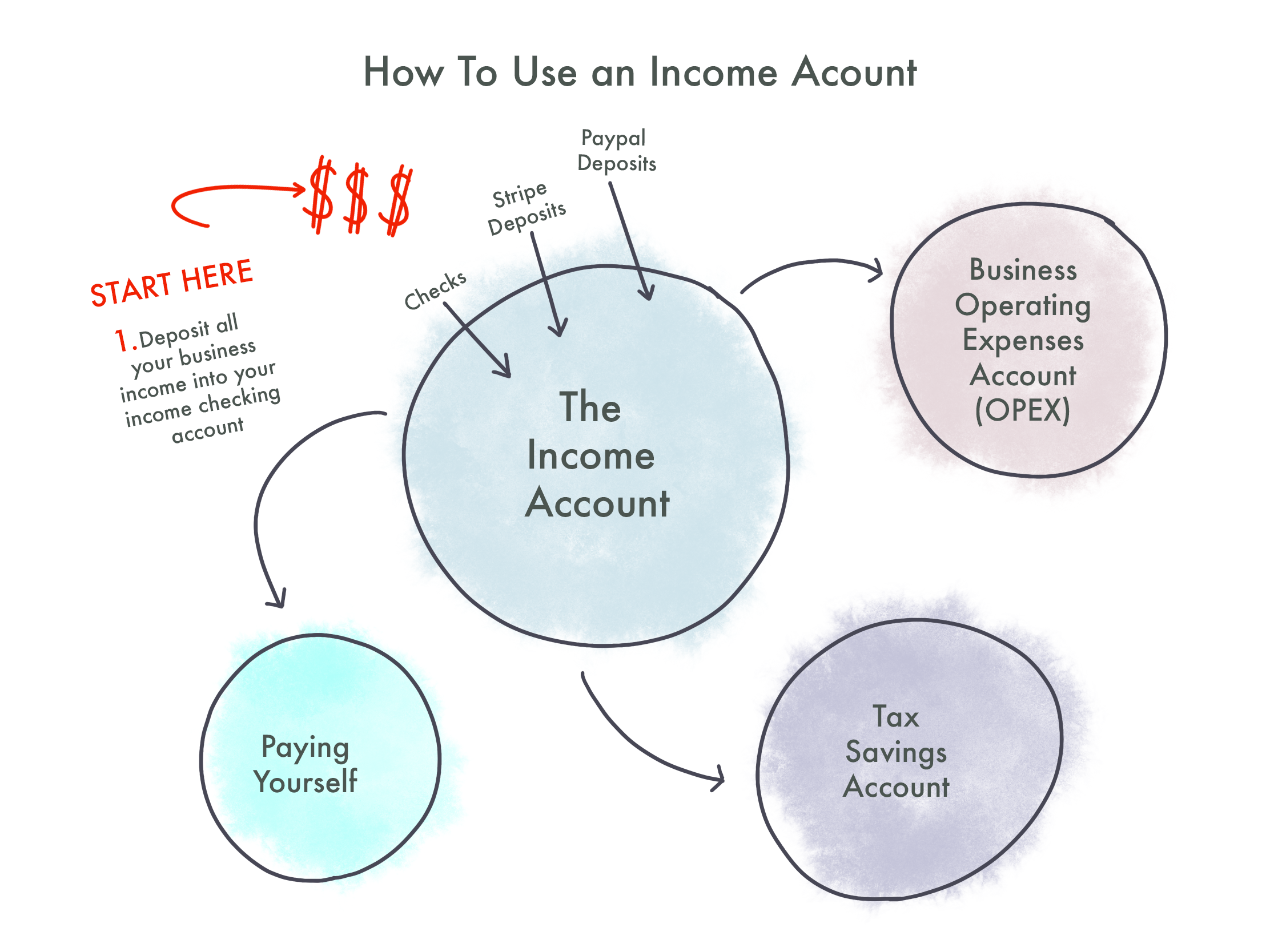

An income account is basically a clearing account. It’s a separate checking account where all my income - which is revenue from products and services - gets deposited. The income account is where I deposit checks from clients and where I set up my payment processors, like Stripe and PayPal to deposit my business income into.

Then every week, I disburse the money that’s sitting in the income account in the following fashion:

I transfer a portion into my business operating account,

a portion gets saved into a tax savings account and then,

I pay myself via a transfer into my personal account (my bills, bills, bills account).

I never pay for any business expenses from my income account; I only use it to receive income and then make the disbursements I mentioned above.

Here’s what it looks like in practice:

What’s An Operating Account?

An operating account, or OPEX for the accounting nerds, is the business checking account used to pay for your business expenses. Business expenses are all the costs that are

"regular and necessary” for running your business. Some examples of business expenses are things like rent for your co-working space, the cost of your contractors, the endless amount of apps and softwares you use, paying your bookkeeper and your lawyer.

How Much Should You Transfer?

Before you dive in, first, let’s look at the amount of income your business generates as 100% of a pie. Trigger warning: math ahead. Figuring out how much you should transfer is figuring out how to divide the pie.

At minimum, you’ll need to figure out how much you’ll pay yourself, including saving for taxes and how much you'll use for business operations. That’s three pie slices. You can always have more pie slices, like retirement savings or a business savings fund, but let’s first just look at these three slices to keep it simple.

Currently, here’s how I allocate 100% of my revenue:

55% gets moved to the operating account,

28% gets paid out to me for my salary,

and 17% gets transferred to an income tax savings account.

When I first started this system, I had a larger allocation going to the operating account and less being saved for taxes. That was because I needed more money going into the business to feel comfortable with being able to meet my expenses and have enough cushion.

In order to figure out how to subdivide your pie, first let’s figure out how much you need for each piece. We do that by looking at how much you’ve allocated in the recent past.

Work Backwards to Deconstruct What You Need to Earn

One thing I really liked about this new process, was how it forced me to look at how I’d been allocating my income. After looking back, I had a better understanding of how my income needed to change in order to impact my pay and how much I could be invest in the business.

So first, you need to look at recent history to come up with an idea of what this system will look like in practice and if those numbers will work. Yes, it’s time to open up a spreadsheet.

Calculate the Average Monthly Business Income

First list out how much your business has earned each month over the past twelve months?

Next, figure out what’s the average monthly income has been.

What Did You Pay Yourself?

First, list out how much have you paid yourself each month over the past twelve months?

Next, figure out what’s the average monthly pay has been.

Then, express that average monthly pay as a percentage of monthly income.

How To Do the Math: Take your average monthly pay and divide it by your average monthly business income

Example:

Average pay = $2,167

Average monthly income = $6,250

Pay expressed as a percentage of income = ($2,167 / $6,250 = .0346) x 100 = 35%

How Much Was Spent on Operating the Business?

Please tell me you have been doing your bookkeeping each month.

If so, run your profit and loss reports to see your month over month expenses over the last twelve months.

Next, figure out the average monthly expenses.

What is that expressed as a percentage of revenue?

How To Do the Math: Take your average monthly expenses and divide it by your average monthly business income

Average OPEX = $3,667

Average monthly income = $6,250

Pay expressed as a percentage of income = ( $3,667 / $6,250 = .0586) x 100 = 59%

Income Tax Savings

If you owed taxes last year, how much did you owe?

Did you have a savings plan? If you did, did you save enough?

Next, express the amount of taxes you owed as a percentage of income?

How To Do the Math: Divide the annual taxes owed by your annual income. Or you can divide monthly taxes owed by your monthly income.

Example: $10k owed annually divided by $100k of annual income is 10% taxes.

Here’s what your analysis might look like:

Projecting Forward

Now that you can see what your business did, it’s time to make adjustments to income to see how it impacts how much you pay yourself, how much you save for taxes and how much you have for business expenses.

Here are some examples of how you can project forward:

Step 1: Project a new income number

Step 2 - 4 are interchangeable.

Play around with the numbers and make sure that the $$$ splits equal the income and the % splits equal 100%.

A Few Big Fat Caveats

Taxes

Depending on your income, you might save more for taxes, but I’m super not bummed about that. You can use the extra cash for retirement savings, you can reinvest it into the business or you can pay yourself a bonus.

Contractors + Payroll

You might have some logistical issues if you’re using a payroll service provider and paying contractors. You’ll need to make sure your operating expenses will always cover your contractor and/or staffing costs.

Keeping Track

The only way that this method works, is if you use it consistently. I know, how annoying of me to ask you to look at your finances on a regular and consistent basis, but it’s like all the other things in your life. Here are some examples that will not just annoy you, it will help me drive the point home. If you want to be a writer, you probably have to write every week, if not every day. If you want to be fit, you have to consistently not eat crap and consistently move your body. If you want to get good at playing an instrument, you have to practice a little bit over a lot of time. See how that works?

So the best way to keep track is to use a spread sheet that you update each week. I made one for you, because I’m fucking cool like that.

The Results

What I learned looking back was that I needed to increase my income by a lot more than I thought. Over the last twelve months, by looking closely at income, I was able to examine what my opportunities were. I looked at ancillary services I was providing and realized by amping that up, I could easily hit higher targets. Thinking about your business in this way is essential if you want to run a business.