Photo by Jeremy Lapak

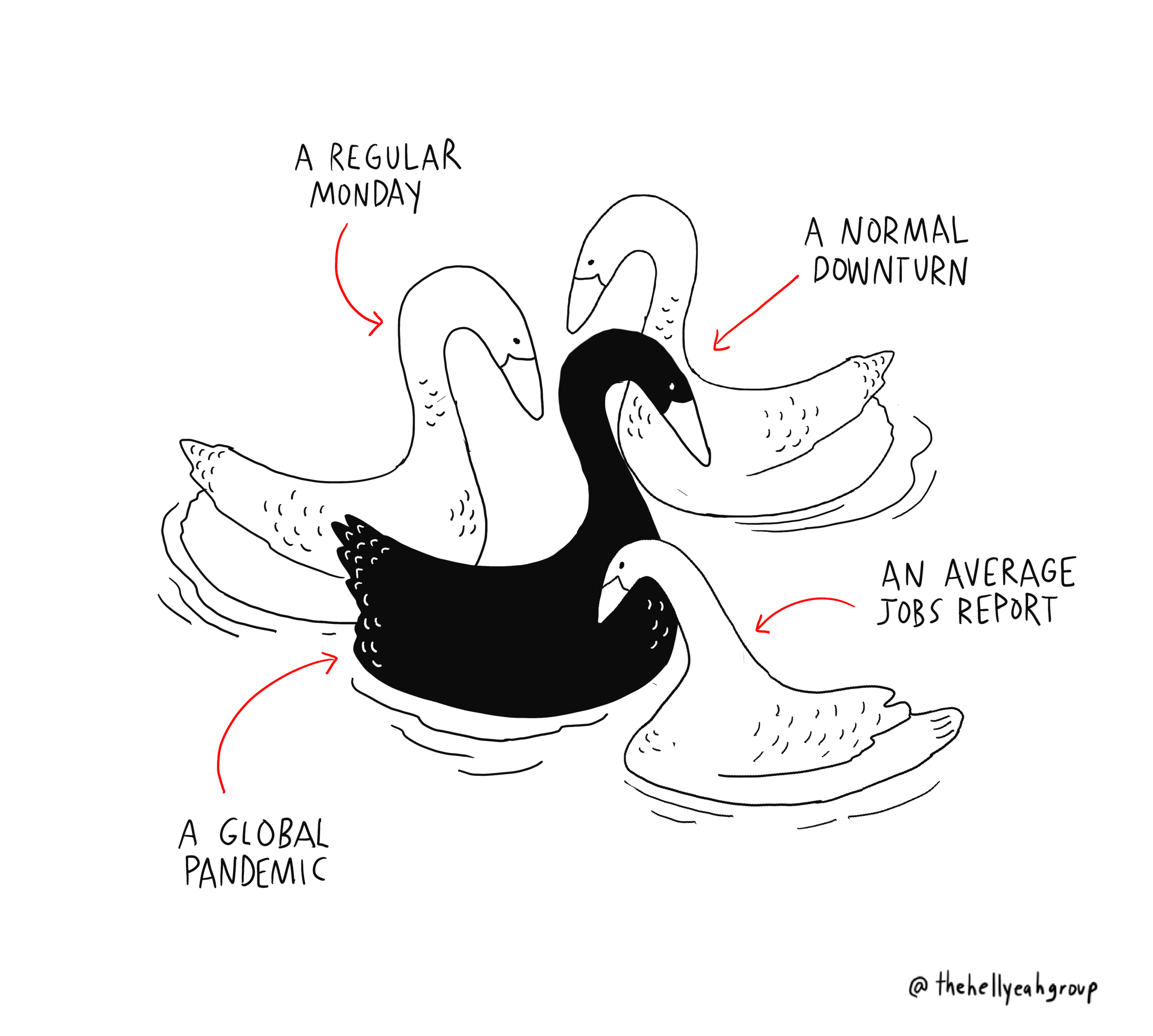

In the financial world, we call things like the current pandemic a black swan event. A black swan is an unpredictable event with potentially severe consequences. The name comes from the rare sightings of black swans in nature. They exist, but seeing them is exceptional. So while the financial world has terms for these types of events, how we deal with them isn't always the same. Take the 2008 housing crisis. It was the result of a perfect storm of things: sub-prime mortgages, derivatives, hubris, and the lax, or often fraudulent practices within the real estate, mortgage and lending sectors. Finding a way out of the crisis was terrifying, but pointing to the causes gave us a sense of certainty.

I want to be clear: what we're experiencing today is very different from the housing crisis of 2008. Although there is one similarity: we didn't have a playbook for dealing with the crisis then, and it goes without saying, we don't have one today. While it's true, the world has experienced pandemics in the past, our modern economy, in all of its globally connected glory, has not experienced something of this scale. I have no idea what is to come in the approaching days, weeks, or months. I'll do my best to help you all understand our changing reality through the lens of money, finance, and economics.

Here are my thoughts on how to not freak out about your finances during a global pandemic.

The most important thing to do is to remain calm, do not panic, and try not to take a reactionary approach. Freaking out doesn't help any situation. It generally makes the situation worse because you can make rash decisions while under duress.

The Inflow Side of Things

First, figure out how much money you can expect to come in over the short-term. A good place to start is to find out how your employer will handle payroll. Some companies are laying off employees, others are continuing to pay full salaries, and some are paying workers a reduced income. Figuring out what you can expect to come in over the next one to three months will give you a baseline of expectation. Having a baseline will give you an idea of what you're working with, so you can determine if you need to bridge any gaps with savings, by cutting expenses, going into debt, or some combination of these options.

Are you elibigible for unemployment benefits?

If you've lost your job, are furloughed or your income has been decreased, you can file for unemployment. With the recent stimulus bill, unemployment benefits have been expanded and now include freelancers, furloughed employees and gig workers, such as Uber drivers.

Tapping into your emergency fund

If you have money saved up in your emergency fund and income is going to be cut in the short-term, you might have to tap into your emergency fund. Of course, it sucks because you'll have to save it all over again, but that's the point of having an emergency fund: it's there for you to use in an emergency. Review what you have in reserves so you can know what's available for you to draw on.

I am well aware that 40% of Americans don't have enough money to pay for a $400 emergency and, therefore, do not have an emergency fund. The painful reality is that this crisis is going to hurt those people the most. But my optimistic hope is that this crisis wakes everyone up, especially our leaders and wealth hoarders, so they realize that our system lacks support and needlessly creates a precarious existence for people. It needs to change, and I am hopeful it will. In the meantime, the short-term is going to hurt like a motherfucker, but we will all get through it. Relief programs may not bridge the entire gap for everyone, but it's a start.

Understand that Governments and companies are creating relief programs in real-time

Governments around the world, at all levels, are creating relief programs for their citizens. It's happening in real-time, so information is coming out as laws get passed. The best way to stay updated is by reading the actual laws or getting counsel from your accountant. Right now, our leaders do not have a choice but to strangle capitalism to preserve human lives. They are forcing businesses and people to forgo earning a living to have lives to go back to. To do that, they must facilitate these relief programs to supplement all of our lost income or reduced wages. Programs to support both small (and large) businesses and individuals are in the process of being created.

As of this writing, here are the current laws the US has passed and is working on to provide relief to Americans:

The $8.3 billion emergency spending bill

This emergency bill was signed in early March to disperse $8.3 billion to the health secretary, state, and local health departments, to buy vaccines and treatments and to prevent the spread of COVID-19 internationally.

Families First Coronavirus Response Act

President Trump signed this new act into law on March 18, 2020. The bill includes provisions for paid sick leave, free testing, and expanded unemployment benefits. The legislation seeks to make testing for the coronavirus free to the public (without having to use deductibles or copayments), establishes a federal emergency paid-leave benefits program to provide payments to some employees, boosts unemployment benefits, and offers nutrition assistance and access to meals for those who are in need.

If you're sick, taking care of someone who is ill with COVID-19, need to stay home to watch your children because schools are closed, or need to quarantine, your employer might be able to provide you emergency benefits under this new law. The new law, which goes into effect no later than April 2, 2020, covers employees of businesses with fewer than 500 employees in two areas: sick leave and family leave. Under the law, full-time employees can get 80 hours of sick leave (with part-time workers getting a proportionate share) for COVID-19 related emergency sickness. Additionally, those covered by the act can get up to 12 weeks of family leave (with the first two weeks unpaid) if they must stay home with children whose schools and daycare centers have closed because of the pandemic. Employers will get a 100% credit for these costs (up to a specific limit). The costs will be credited quarterly, and employers will also be exempt from payroll taxes on these benefits. So these benefits are 100% "free" to employers but will be included in taxable income, and employers must first pay for them with business cash and then receive a credit. If you are an employer, talk to your accountant or attorney and your payroll service provider to help you figure out the details for implementing this.

The $2 trillion stimulus rescue package

At the time of publishing this article, the Trump administration officials and top Democrats have just finalized an agreement on a roughly $2 trillion rescue package to confront the coronavirus pandemic, the largest economic stimulus measure in modern history. It proposes provisions to provide relief for small businesses, cities and states, cash assistance for taxpayers, hospitals, health care service providers, and loans to companies in major industries.

Specifically, the bill proposes payments for taxpayers of $1,200 per adult who reported less than $75,000 in income on their 2018 tax returns and an additional $500 for every child. Payments would be phased out for higher earners. A single person making more than $99,000, or $198,000 for joint filers, will not get anything. We can expect the first payment around April 6, and the second on May 18 if the crisis hasn't abated.

The bill, proposed by Senate Republicans, has been met with criticism from Democrats, complaining that it gives too many benefits to corporations with little oversight of how to spend the money. Democrats worry that lack of oversight could mean companies pocket funds instead of supporting their employees. President Trump seemed to echo the sentiment in a statement he made at the White House. "I don't want to give a bailout to a company and then have somebody go out and use that money to buy back stock in the company and raise the price and then get a bonus. So I may be Republican, but I don't like that. I want them to use the money for the workers."

Some small business loans might also automatically convert to grants if they are used for things like rent and continuing to pay employees. The details of all of these laws are being hammered out.

Everything is changing very quickly, and I wish I had more definitive answers and solutions about how to navigate the income side of this crisis, but there aren't right now. Our biggest concern cannot be a financial one at the moment. We are all in the same uncertainty of surviving first and then figuring out the details later.

Some economist predict a recession, others predict a pending depression, but many also think a recovery could happen sooner than we think considering China's ability to stop the growth of infections. Only time will tell. We can only wait and see.

All of this is to say, relief is coming down the pike, and in the short-term, we have to do everything we can to remain calm so that we're making decisions somewhat rooted in rationale and not entirely in fear and uncertainty.

The Outflow Sides of Things

Shifting your focus to your expenses can help you feel like you have more control since you're able to take action and make a change.

Review your budget

You're probably going to be spending a lot less with your newfound routine of almost never leaving your house. There are no concerts and bars, and discretionary spending is limited to online shopping. Now is a great time to revisit your budget.

If you've never created a budget before, check out our guide here. I teach a particular budgeting method that forces people to know how much their essential and necessary bills and expenses are. It's critical to view your expenses through this lens because it allows you to understand what your baseline expenses are. This baseline is your emergency budget if you need to cut back almost entirely on the non-essentials in your life.

A lot of you might have automatic transfers going into your savings and investment accounts. For those who can afford to, you can keep saving and investing. If you are anxious about short-term cash, you can consider stopping any automatic investing or savings transfers.

The one expense you will probably see an increase in is your utility bill. Since you're staying at home and cooking all your food, you'll probably see it go up with a bump in usage.

Reach out to companies to find out about relief options

Beyond cutting discretionary spending, you can also reach out to various companies to find out about their relief options. Utility companies, the banks you borrowed from for your house or car, credit card companies, television cable service providers, internet service providers, and student loan servicers might all have different relief options. Since all these companies are independent of one another, and new laws are in flux, they all might be creating similar, but still different relief programs. Your best bet is to look online to see if the various parties have issued a statement with how they plan to handle payments or relief options during the crisis.

Federal Student loans

Borrowers with federal student loans can pause payments for two months without interest accruing. You'll need to call your student loan service to request forbearance to stop the loan payments for at least two months, retroactive to March 13.

Talk to your landlord, lenders and local elected officials

Even if you can afford to pay for your rent or mortgage, it's a good idea to find out what options are available to you. Options give you a sense of freedom, choice, and control.

If you are worried about being able to pay your rent or mortgage, then knowing what your options are is imperative. For those with mortgages, the Federal Housing Finance Agency (FHFA) is reminding everyone about forbearance. Forbearance allows you to skip your mortgage payments. But interest will continue to accrue, so while it will help you in the short-term, you will end up paying more in the long-run.

In college, I worked as an auto loan debt collector for a big, evil bank. One of the things we offered to customers who were experiencing financial hardship was an extension on their payments. Extensions effectively took the next few payments and put them on the end of the loan, extending the life of their loan and costing them more in interest. We offered one to three-month extensions, but the terms varied, and the bank had specifics things you had to do to apply. The best way to find out what these terms are is to reach out directly to your lender to find out what your options are.

If you have an FHA-insured mortgage, there is a moratorium on evictions and foreclosures for the next 60 days, so you can feel assured that you will have shelter.

Most cities are also implementing eviction bans during the coronavirus, which is excellent from a worst-case scenario. But the reality of the long-term doesn't look great. Low-income renters whose wages have gotten cut or jobs lost may find themselves in a situation where they owe back rent, saddling on more debt to those who can least afford it. If you're worried that you'll find yourself in this position, you should reach out to your landlord to find out if there are any options for you.

The short-term will be tough, but organizations are mobilizing to help protect vulnerable families. Notably, in Los Angeles, the Healthy LA Coalition was formed to urge our elected officials and courts to halt evictions and foreclosures, to request the creation of a citywide rental assistance fund and implement other protections for vulnerable Los Angeles families. If you live in Los Angeles and you want to act now, here are details on how you can help. They even have a script you can use to reach out to your local council members.

I'm sure there are organizations like this popping up in other cities. Please take the time to help others during this crisis. The one thing this crisis has shown us is that every action you choose makes a big difference in the world, and our interconnectedness is undeniable.

The Asset Side of Things

The market is reacting, but you should not. Also, none of this is investment advice because I cannot legally give any.

Millennials, Don't Touch Your Face or Your 401(k)

If you're looking at your 401(k) or your retirement funds, you're needlessly torturing yourself. The market is insane right now, and you don't have any option except to wait and see this thing through. If you're young and you aren't planning on retiring anytime soon, you seriously don't need to be checking your retirement accounts. If you're older and retiring soon, if you've allocated your investments appropriately, that's the best-case scenario for diversifying and hedging your risk. In other words, your investments should reflect the amount of risk you can take considering how close you are to retirement.

Other investments

If you have other investments, that money should be money that you didn't need in the short-term. Therefore, you invested it. And general financial wisdom says, if it isn't money you need in the short-term, then there isn't any reason to guarantee a loss by selling it now. Stop checking it; it's only going to bum you out.

Manage your risk

We are all taking precautions to manage our risk, to limit our downside and potential losses. Staying home and interacting with as few people as possible will limit your exposure to the risk of falling ill. And limiting your risk of falling ill will limit your loss of income due to not being able to work. Staying healthy will also limit what you might have to potentially pay in hospital bills if you were to, unfortunately, fall on the wrong side of the statistics. Think about things in this kind of inverse - how much are you willing to lose? How much are you ready to risk?

The Emotional Side of Things

At this current point in time in the crisis, there is very little any of us can do. We have to learn how to surrender into this groundlessness and accept what lies ahead. Beyond financial strain and falling ill, our biggest challenge will be dealing with everything happening between our two ears. For those who have anxiety, it won't just be mental stress; anxiety manifests itself in your body. In my experience, the best method for coping with uncertainty is reconnecting with my body and being completely present to the moment. Being entirely present for the moment you are in is the only way not to feel anxious about a time that is not now.

Here are the things that work for me. These suggestions are not a prescription, just what works for me. Box breathing, meditation, exercise, especially if it's very strenuous, going for a walk, going for a run, writing, playing music, dancing, getting the fuck off of social media, gardening, puzzling, juggling, and helping people through my work. The only way out is through. And we will get through.